EVENTS

Kalendar predstojećih balkanskih dešavanja u Čikagu, Njujorku, Majamiju i ostalim američkim gradovima. Upcoming Chicago events in Serbian and Balkan community.

DODAJ DEŠAVANJE ILI DOGAĐAJ

Srpska Televizija nije odgovorna za promene datuma i mesta zakazanih događaja.

Treasurer Maria Pappas and ABC 7 Chicago will host “Black and Latino Houses Matter” on March 11, 2021, a phone bank to help Cook County homeowners find refunds, apply for property tax exemptions and avoid the Tax Sale, Pappas said today.

“I am grateful to ABC 7 for participating in my program to return money to taxpayers and prevent them from losing their homes because of unpaid taxes,” Pappas said. “While the Tax Sale

disproportionately impacts Black and Latino homeowners, all Cook County homeowners are welcome to call the phone bank.” John Idler, President and General Manager of ABC 7 Chicago, said: “It’s gratifying to join forces with the Treasurer’s Office to help Cook County homeowners get much needed information and resources, especially in Black and Latino communities hardest hit by the pandemic. The phone bank will go a long way to provide struggling homeowners assistance and reaffirms that working

together to help our community makes us all stronger.”

Here are the phone bank details:

Date: March 11, 2021

Time: 3:00 p.m. to 7:00 p.m.

Phone Number: 312.603.5105

Samantha Chatman, a consumer investigative reporter with ABC 7’s I-Team, will report on the

phone bank during the station’s newscasts. A team from the Treasurer’s Office, fluent in Spanish,

Polish, Chinese and English, will:

• Search $76 million in available property tax refunds

• Check if you are eligible for $46 million in missing tax exemptions

• Verify if your property is on the Tax Sale list with delinquent taxes

Cook County Treasurer’s Office – 9/13/2021

Check your properties before sale starts Nov. 5

Cook County Treasurer Maria Pappas will conduct the first sale in more than two years of delinquent Cook County property taxes on Nov. 5, 2021.

About $163.4 million in unpaid 2018 property taxes (that were to be paid in 2019) is due on 36,000 homes, businesses and land. Less than $1,000 is owed on 11,744 properties in Chicago and 7,700 properties in suburban Cook County.

Pappas is sending owners of those properties a certified mailing informing them that their unpaid taxes are scheduled to be sold, which would put a lien against their properties. It is the first step in a process that can end with the loss of a property.

Owners can avoid the Tax Sale by paying the delinquent taxes and interest before the sale begins. To see if your taxes are delinquent – and to make a payment – visit cookcountytreasurer.com and select “Avoid the Tax Sale.” You can search by address or by Property Index Number (PIN).

“About 75% of the taxes offered for sale are for properties in majority Black and Latino communities,” Pappas said. “That’s why Black and Latino Houses Matter, my program to help homeowners find refunds and apply for tax exemptions, is so important.”

Owners may be unaware the taxes on their properties are headed to the Tax Sale because the U.S. Postal Service has returned bills and subsequent notices on 17,702 properties.

Also, as many as 207 seniors may be missing a senior exemption and 184 seniors may be eligible for a senior freeze – two exemptions that could reduce their tax bill. “Everyone should visit cookcountytreasurer.com for more information,” Pappas said.

Per Illinois law, the annual Tax Sale traditionally is conducted 13 months after the due date but was delayed because of the COVID-19 pandemic. Pappas plans to conduct the sale for 2019 unpaid taxes in May and for the 2020 taxes in November 2022.

OFFICE OF THE COOK COUNTY TREASURER

Maria Pappas

On May 12, 2022, Cook County Treasurer Maria Pappas will begin

the sale of unpaid 2019 property taxes that were originally due in

2020.

Property owners can avoid the Annual Tax Sale by paying the

delinquent taxes and interest before the sale begins.

• To see if your taxes are delinquent – and to make a payment

– visit cookcountytreasurer.com and select “Avoid the Tax

Sales.” You can search by address or by Property Index

Number.

• About $219 million in unpaid 2019 property taxes is due on

44,741 homes, businesses and land.

“Unpaid taxes are found in all communities, but almost 79% of the

taxes offered for sale are for properties in Black and Latino

communities,” Pappas said.

“Property owners should visit cookcountytreasurer.com to see if

they are receiving all possible exemptions to pay only what they

owe,” Pappas said.

Tax buyers interested in participating in the sale should visit

cooktaxsale.com to register for the sale or purchase a list of

properties with delinquent taxes. Registration will be open from

March 25 to May 2, 2022.

Dear Parish Families,

In a world full of CHOICES, parents are faced with so many choices of extracurricular activities for their children: sports, dancing, crafts, music groups, language classes to name a few – but sadly, Church School rarely makes the cut for necessary activities. There’s just no time left after all the rest. But please, consider the well-being of your child and their faith as they grow and face the world – what is more needed today than a strong, cemented foundation upon which children can build their scaffold of faith from the ground up? It’s hard to imagine anything that should take first place over that. Please consider signing up your children for Church School this year!

You can register for Church School or the other activities being offered at the following link:

https://form.jotform.com/

If you have any questions about Church School, please contact Popadija Katya at HRSOCChurchSchool@gmail.com. Thank you!

APSOLUTNO ROMANTIČNI

Prof. dr Tomislav Terzin, održaće tribine pod nazivom

” Da li je svet na samrti” , 14 septembra od 6pm.

Kako preživeti kraj sveta u subotu 16 septembra od 6pm

Tribina obuhvata naučno-biblijski pogled na kraj sveta.

Adresa 5608 N Pulaski Rd, Chicago, IL 60646.

Analiza računa za porez na imovinu okruga Kuk od 1,8 miliona za 2022. pokazuje da su školski okrugi uglavnom odgovorni za velike poreske račune koji dospevaju 1. decembra, kaže blagajnik Marija Papas.

Srednji račun za boravišnu taksu u severnim i severozapadnim predgrađima povećan je za 15,7%, što je najveći procenat povećanja u najmanje 30 godina, pokazala je analiza. Ovi veći poreski računi su rezultat povećanih nameta ¬¬— iznosa novca koji traže poreski okrugi — i prebacivanja poreskog tereta na vlasnike kuća sa preduzeća kao rezultat ponovnih procena u severnim predgrađima.

pročiajte ceo tekst ispod:

Pappas: School districts hiked property taxes on Cook County homes, businesses

An analysis of Cook County’s 1.8 million property tax bills for 2022 shows that school districts are chiefly responsible for hefty tax bills that are due Dec. 1, according to Treasurer Maria Pappas.

The median residential tax bill in the north and northwest suburbs increased 15.7%, the largest percentage increase in at least 30 years, the analysis found. These higher tax bills are the result of increased levies — the amount of money sought by taxing districts — and a shift of the tax burden onto homeowners from businesses as a result of reassessments in the northern suburbs.

Treasurer’s Office researchers Hal Dardick and Todd Lighty led the analysis. Pappas hired the former Chicago Tribune investigative journalists to head up her office’s think tank. The analysis is the latest addition to the Pappas Studies, a series of examinations of the complex property tax system available at cookcountytreasurer.com.

Key findings of the analysis show:

- Of 940 taxing agencies in the county, 676 — or 71.9% — increased taxes.

- The amount of taxes billed to property owners countywide rose more than $909 million from $16.7 billion to $17.6 billion, a 5.4% increase over 2021. Homeowners are shouldering $599.1 million, or two-thirds of the increase, while commercial properties are picking up one-third and owe an additional $314.4 million.

- In newly reassessed north and northwest suburbs, taxes rose $331 million — with a $387 million, or 12.9%, increase on residences and a $56 million, or 2.7%, decrease on commercial properties.

- In the south and southwest suburbs, taxes rose $173 million from $3.88 billion to $4.06 billion. Residential taxes increased $98 million, or 4.1%, from $2.4 billion to $2.5 billion, while taxes on commercial properties increased $75 million, or 5.1%, from $1.48 billion to $1.56 billion.

Cook County is divided into three areas for reassessments: the city of Chicago, north suburbs and south suburbs. The county assessor calculates new values for properties in each region once every three years, a process known as triennial reassessments.

Property values are one factor in the complex property tax system. Local units of government set tax levies that determine how much money they need to operate. The assessed values of properties and amounts of levies determine the tax rates, which vary widely among communities.

State law allows school districts to hike taxes by the prior year’s increase in the consumer price index, or 5%, whichever is less. Because the CPI increased by 7% in 2021, school districts were allowed a 5% increase. But the overall percentage increase was higher, partly due to a new provision called recapture.

Recapture, which took effect in the 2021 tax year due to a change in state law, allows schools and other taxing bodies to recover money that was refunded to property owners whose assessments were lowered by the Illinois Property Tax Appeal Board, state courts or county offices.

Recapture accounted for $203.7 million countywide for 2022, a $72.7 million increase from last year.

Significant increases in the amount of money the city of Chicago and Chicago Public Schools said they needed to operate, coupled with the recapture provision and higher tax increment financing district bills, boosted the overall property tax burden in Chicago by $410 million from $7.65 billion to $8.1 billion. That broke down as a $296 million, or 7.8%, increase on commercial properties and a $115 million, or 3%, increase on residential properties.

Chicago Public Schools recaptured $50.8 million for the 2022 tax year. As a home rule municipality, the city of Chicago is unable to recapture taxes, as the state law applies only to non-home rule communities.

The Treasurer’s analysis revealed that throughout Cook County in 2022, the amount owed to tax increment financing districts increased $124.6 million from $1.43 billion to $1.56 billion. TIF district increases account for about 13.7% of the overall rise in what property owners across the county owe.

Second Installment 2022 tax bills are set to be mailed Nov. 1 and are due Dec. 1. Property owners who don’t wait to wait for their bills to arrive in the mail can pay their taxes online now at cookcountytreasurer.com. Partial payments are accepted.

https://cookcountytreasurer.com/pdfs/taxbillanalysisandstatistics/taxyear2022analysis.pdf

Cook County property owners have no need to wait for their next property tax bills to arrive in the mail to find out how much they will owe by the March 1 due date, Treasurer Maria Pappas said today.

Taxpayers can visit cookcountytreasurer.com to view, download and prepay their First Installment 2023 property tax bills.

Property tax bills are divided into two annual installments. The First Installment, which is 55 percent of the previous year’s total tax, is due March 1, 2024. By providing an early look at the bills, property owners can plan their finances or make payments before the end of the year.

“A lot of bills come due after the holidays,” Pappas said. “By posting First Installment bills online months before they are due or even mailed we strive to help people manage their household budgets and plan accordingly.”

The Treasurer’s Office expects to mail First Installment 2023 bills to owners of about 1.7 million properties around Feb. 1.

Visiting cookcountytreasurer.com and follow these steps to download your tax bill and make a payment:

- Select the blue box labeled “Pay Online for Free”

- Enter your address or 14-digit Property Index Number (PIN)

There is no fee if you pay from your bank account. The Treasurer’s Office accepts partial payments but First Installment taxes must be paid by March 1 to avoid a late charge of .75 percent per month, as mandated by Illinois law.

You can also use cookcountytreasurer.com to:

- Search $93 million in available refunds.

- Check if you are missing out on $57 million in property tax exemptions, which lower your tax bill.

Krajnji rok za plaćanje poreza je 01 Mart ove godine, saopštila je blagajnica Cook sreza Maria Pappas. Proverite da li ste kvalifikovani za povrat novca od poreza iz fonda od 150 miliona dolara uključujući vlasnike kuća, starije osobe i seniore koji su oslobođeni od poreza u poslednjih 20 godina.

Unesite svoju adresu na sajtu CookCountyTreasurer.com i proverite

VIDEO SAOPŠTENJE

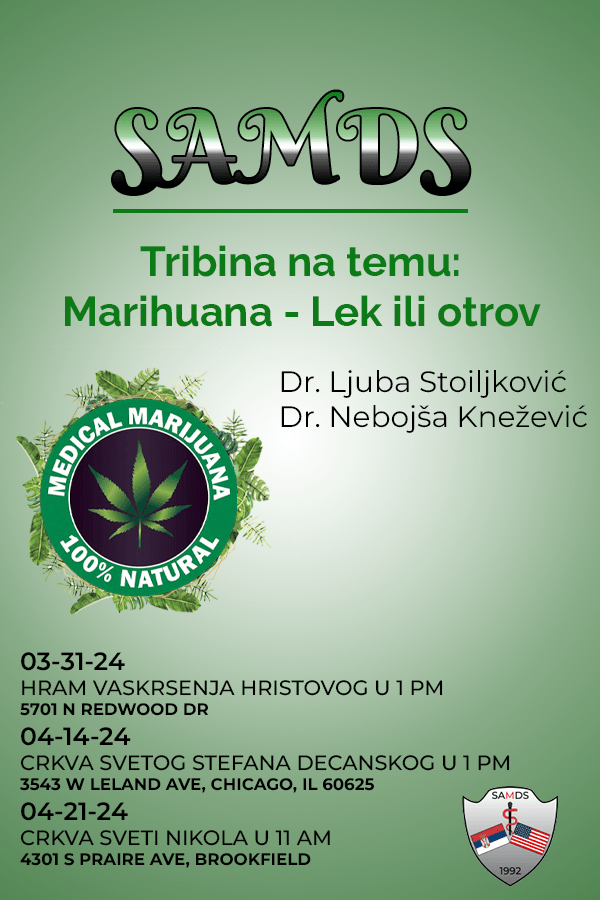

03-31-24

HRAM VASKRSENJA HRISTOVOG U 1 PM

5701 N REDWOOD DR

04-14-24

CRKVA SVETOG STEFANA DECANSKOG U 1 PM

3543 W LELAND AVE, CHICAGO, IL 60625

04-21-24

CRKVA SVETI NIKOLA U 11 AM

4301 S PRAIRE AVE, BROOKDIELD